Have you applied for the Coronavirus Self-Employment Income Support Scheme (SEISS)?

25th May 2020

If you haven’t already checked your eligibility for the Coronavirus Self-Employment Income Support Scheme (SEISS) then you should do so as soon as possible. The scheme provides a valuable income stream for those self-employed that have seen their turnover impacted by the COVID-19 pandemic.

What is SEISS?

SEISS allows the self-employed to claim a taxable grant of 80% of their average monthly profits as a one-off payment covering 3 months’ earnings. You are permitted to continue working even if you receive it (including new trade and/or voluntary work), and this payment is a grant, therefore it does not need to be paid back, although it is subject to Income Tax and NICs. The scheme is temporary but there is a chance it may be extended by HMRC if required.

Who is eligible for SEISS?

Eligibility for SEISS largely depends on the status of your previous tax returns. Whether self-employed or a partner, the following must apply to be eligible:

- You must have submitted a self-assessment tax return for the tax year 2018/2019 on or before 23rd April 2020 and have been trading during this tax year. The trading profits for this year must have been less than £50,000 and at least equal to your non-trading income. HMRC will look at the 2016/2017, 2017/2018 and 2018/2019 tax years if you are not eligible on the 2018/2019 tax return.

- You must have been trading in the 2019/2020 tax year and intend to trade in 2020/2021

- Your trade must have been negatively impacted by coronavirus (this could be because of impact on trading/customers/supply chain/employees or because personal circumstances such as health or caring responsibilities have prevented you working.)

Uncertain Areas of Eligibility

There are some instances where you may not be eligible or the calculations may be more complex. You should seek further clarification if you are unsure as you may make an error in your claim.

- You are not eligible to claim the grant if you are a limited Company or operating a trade through a trust

- If you are on parental leave, then you should still check your eligibility as you may still class as trading and be able to make a claim. Your maternity allowance will not impact your access to this grant.

- If you have been paid for work under the Loan Charge or similar form of credit under this scheme, then you may still be eligible for the grant using your previous tax year return, even if your loans will be removed following the recent government review into this area. Under these circumstances, you will not be subject to the same 23rd April deadline for tax return submission for 2018/2019.

- If you claim averaging relief then HMRC will use your profit before the impact of the average claims to work out your eligibility and total claim amount

- If you are self-employed but a non-resident of the UK or resident but have chosen the remittance basis, then you may still be able to claim the grant. You must confirm your trading status over the 2016/2017, 2017/2018 and 2018/2019 tax years and that annual profits were not more than £50,000. If you were not trading in all of these years then HMRC may still make the calculation based on other tax years.

- If you are in a partnership, each partner will need to make a claim and HMRC will allocate your grant based on your share of the partnership’s profits. There are more details of how partnership eligibility is calculated from HMRC.

There are detailed examples and outlined methodologies for how HMRC will calculate your eligibility here.

How do you claim?

You must make the claim yourself, rather than an appointed agent. Please do not try to use your appointed agency as it will notify HMRC as a fraudulent claim attempt and you will then have to contact HMRC directly to process your claim, rather than using the online service. This could add delays to the process.

The eligibility test and claim are both made online via HMRC. You will need:

- Your UTR Number

- Your National Insurance Number

If you can not remember these, then your accountant or appointed agent may have these for you. You can find both of them on your tax return submission documents or you could also contact HMRC, though expect delays in contact at the moment.

THE ELIGIBILITY CHECK

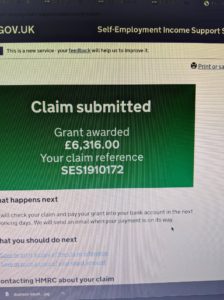

You will first need to check your eligibility to claim. Simply visit this SEISS page on HMRC. It is simple to use with clear instructions and  you should be given an instant response as to your eligibility and how much you will receive. If you are successful, then the final screen will look something like this* – confirming your eligibility and giving you the amount you should expect to receive.

you should be given an instant response as to your eligibility and how much you will receive. If you are successful, then the final screen will look something like this* – confirming your eligibility and giving you the amount you should expect to receive.

*Please note, example illustrative purposes only. Individual totals and eligibility will vary.

If you are eligible, then HMRC will also tell you the date on which you should make a claim, and you will be asked for your contact details. If you are told that you are not eligible and you think this is a mistake you should contact HMRC.

THE CLAIM

To make your claim, head to this HRMC page, enter your UTR Number and have the following details to hand:

- Your Government Gateway user ID and password – (if you do not have a user ID, you can create one when you check your eligibility or make your claim)

- UK bank details including:

- bank account number

- sort code

- name on the account

- the address linked to the bank account

You will also have to declare that your business has been adversely affected by coronavirus.

The grant should be paid into your bank account with 6 working days of your application.

Further Support

HMRC has a list of additional help and support for business owners on its SEISS page. You can also consult your financial advisor or accountant, who should be able to help you with any queries or difficulties. If you are a TTRB Client or would like to use our services for this matter or any other accountancy issue, please do not hesitate to contact us.